west st paul mn sales tax rate

Did South Dakota v. For Sale - 1938 Christensen.

Local Sales Tax Option Saint Peter Mn

File for a Property Tax Refund.

. The average cumulative sales tax rate in South Saint Paul Minnesota is 713. January 2022 7625. This includes the rates on the state county city and special levels.

Automating sales tax compliance can help your business keep compliant with changing. 05 percent West St. The minimum combined 2022 sales tax rate for Saint Paul Minnesota is 788.

The December 2020 total local sales tax rate was also 7625. This is the total of state county and city sales tax rates. The following rates apply to the WEST SAINT PAUL tax region see note above Month Combined Tax State Tax County Tax City Tax Special Tax.

Some cities and local governments in Dakota County collect additional local sales taxes which can be as high as 075. This rate includes any state county city and local sales taxes. Paul sales tax is line number 633.

The Saint Paul Park Minnesota sales tax rate of 7375 applies in the zip code 55071. Remember that zip code. Use this calculator to find the general state and local sales tax rate for any location in Minnesota.

This includes the rates on the state county city and special levels. Saint Paul has parts of it. The latest sales tax rate for Minneapolis MN.

The current total local sales tax rate in West Saint Paul MN is 7625. Saint Paul in Minnesota has a tax rate of 788 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Paul totaling 1. Paul use tax is line number 634.

West Saint Paul in Minnesota has a tax rate of 713 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in West Saint Paul totaling 025. The use tax applies to taxable items used in the City if the local sales tax was not paid. August 2018 7125.

31 rows The latest sales tax rates for cities in Minnesota MN state. Average Sales Tax With Local. The West Saint Paul sales tax rate is 05.

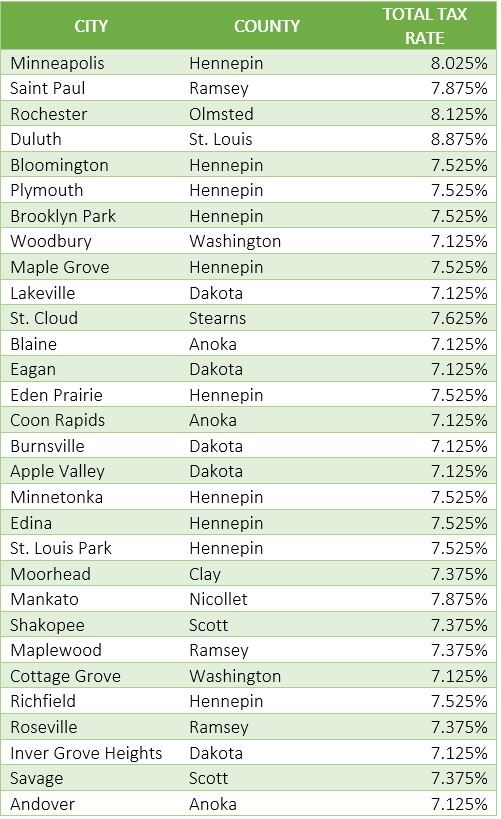

Lowest sales tax 45 Highest sales tax 8875 Minnesota Sales Tax. City of West St. 2022 List of Minnesota Local Sales Tax Rates.

The County sales tax rate is 0. South Saint Paul is located within Dakota. This 05 percent sales tax applies to retail sales made into West St.

There are approximately 4596 people living in the Saint Paul Park area. The latest sales tax rate for Saint Paul MN. Local sales taxes apply to the same items and services as the general state sales tax.

2020 rates included for use while preparing your income tax. The Minnesota sales tax rate is currently 688. Rates include state county and city taxes.

The minimum combined 2022 sales tax rate for West Saint Paul Minnesota is 763. The results do not include special local taxessuch as admissions entertainment liquor. The current total local sales tax rate in Saint Paul.

Metro Counties Sales and Use Tax Rate Guide Effective 04012022 06302022 Metro Counties Sales and Use Tax Rate Guide Local tax rates are listed in the following table. This is the total of state county and city sales tax rates. The Minnesota sales tax of 6875 applies countywide.

The following rates apply to the WEST SAINT PAUL tax region see note above Month Combined Tax State Tax County Tax City Tax Special Tax. This rate includes any state county city and local sales taxes. Apply the combined 7375 percent rate plus any other local.

The average cumulative sales tax rate in Saint Paul Minnesota is 758. File an Income Tax Return. This tax is in addition to the sales taxes collected by the State of Minnesota and Dakota County.

2020 rates included for use while preparing your income. 2020 rates included for use while preparing your income tax. Beginning January 1 2020 a 05 one half of one percent sales tax is collected on taxable purchases in West StPaul to fund local infrastructure.

What is the sales tax rate in Saint Paul Minnesota.

Property Taxes Historical Data Mn House Research

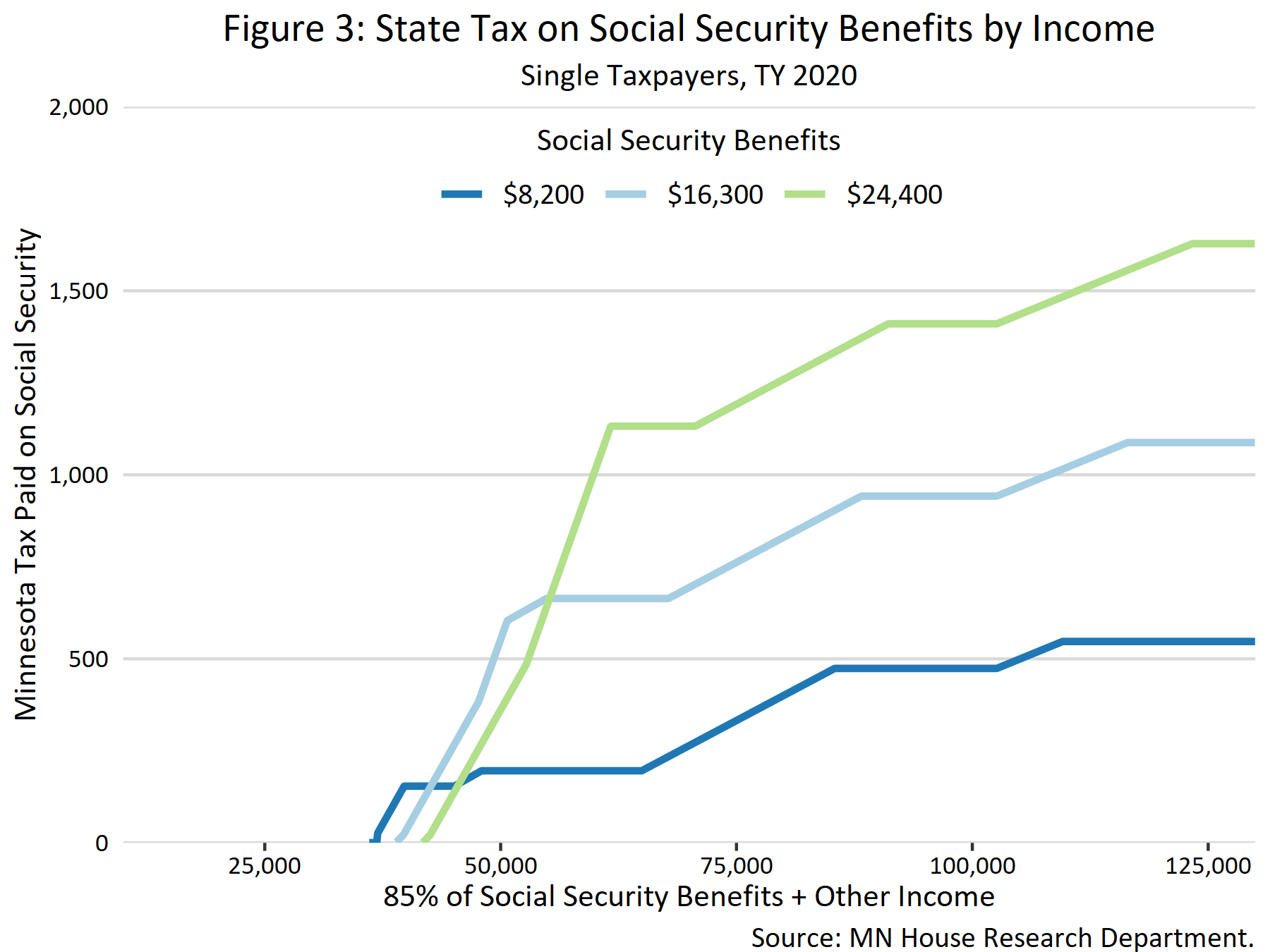

Taxation Of Social Security Benefits Mn House Research

Local Sales Tax Option Saint Peter Mn

Sales Taxes In The United States Wikiwand

Minnesota Sales Tax Rates By City County 2022

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Minnesota Sales And Use Tax Audit Guide

Sales Tax Rate Calculator Minnesota Department Of Revenue

Still Rolling In It Latest Report Show Minnesota Tax Revenues Continuing To Surpass Projections Minnpost

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Property Taxes Historical Data Mn House Research

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Property Taxes Historical Data Mn House Research

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders